State of CAS 2026

Written by

Feb 20, 2026

Ariel Harmoko

Your system of record works. It just wasn't built for what comes next.

Artifact AI | February 2026 | 8 min read

CAS is the fastest-growing segment in accounting. But 97% of firms are running modern services on legacy infrastructure. Here's what the next chapter looks like — and why ripping and replacing isn't the answer.

Client Accounting Services is no longer an emerging trend. It's the economic engine of the modern accounting firm.

Revenue is doubling every three years. Median growth sits at 17%. And 90% of firms with CAS offerings say it's critical to their future.

But here's the paradox nobody wants to talk about: the industry is scaling 21st-century advisory services on infrastructure that was designed to produce financial statements, not power autonomous workflows.

That number should stop every head of CAS in their tracks.

Not because the technology doesn't work. It does. QuickBooks Online, Xero, Sage Intacct, NetSuite: these are proven, battle-tested systems of record. They handle the core accounting. The problem is that "handling the core accounting" is no longer enough.

And it's not just the general ledger. It's the entire firm stack. Bill.com for AP. Gusto for payroll. Excel for everything that doesn't fit elsewhere. Slack and Teams for client communication. Every one of these tools works independently. None of them were designed to work together autonomously.

The growing demand is outpacing the infrastructure

The demand side of CAS is unambiguous. Businesses, especially SMBs in the $2M to $20M revenue range, are hungry for outsourced financial leadership. They can't afford a full-time CFO. They need real-time visibility into cash flow, not quarterly reports delivered three weeks late.

They're willing to switch firms to find it.

On top of that, the accounting talent shortage is acute. Firms can't hire fast enough to keep up with client demand using traditional staffing models. The math doesn't work: you can't solve a capacity problem by hiring into a profession where 300,000 accountants have left the workforce in the last decade.

The only answer is leverage through technology. Specifically, through agentic automation that can execute accounting workflows autonomously, accurately, and at scale.

The rip-and-replace trap

When firms recognize the technology gap, the instinct is predictable: rip out the old stack, replace it with something new. Go all-in on a modern platform that promises to fix everything.

It rarely works. And the reasons are structural, not strategic.

Cost is prohibitive. A full technology migration for a mid-size CAS practice runs $50K to $200K+ in direct costs: software, implementation, data migration. That's before you account for the hidden costs. Those hidden costs are where the real damage lives. Six to eighteen months of disrupted operations. Degraded client service during the transition. The very real risk of losing clients who didn't sign up for a platform change.

Training compounds the problem. In an environment where every CAS professional is already stretched thin, retraining staff on a new system is a luxury most firms can't afford. The hours lost to learning curves are hours not spent serving clients. In a talent-short market, that's an existential trade-off.

Change management is the silent killer. Even if the new platform is objectively better, the organizational friction of moving an entire CAS practice onto it creates a burden that derails firms for quarters. Updating processes. Rewriting templates. Rebuilding integrations. Re-training the team. It all compounds.

Standardization is a myth for most firms. The dream of getting every client onto one platform sounds elegant in a strategy meeting. In practice, your construction clients run Sage, your startups are on QBO, your mid-market accounts use NetSuite, and nobody is switching. Clients have their own AP workflows through Bill.com, their own payroll on Gusto, their own spreadsheets in Excel. You can't force a single-stack migration without hemorrhaging the very clients your CAS practice depends on.

So the real question isn't "which new platform should we buy?"

It's: how do we make the platforms we already have do what we need them to do next?

The system of record wasn't built for agents

This is the core insight that most of the industry is still catching up to.

Your QuickBooks, your Xero, your Sage. They work. They do what they were designed to do. But they were designed for humans to operate, not for AI agents to read, reason about, and act on autonomously.

The gap shows up in two dimensions that we think about as dry code and wet code.

Dry code

The technical infrastructure: APIs, authentication schemas, webhook configurations, rate limits, data models, endpoint behaviors. Every platform in the CAS stack implements these differently.

QuickBooks Online's API has entirely different patterns than Xero's. Bill.com's webhook architecture is nothing like Gusto's. Excel files live in OneDrive or SharePoint with their own Graph API. Slack and Teams have separate messaging and notification models.

An agent that can post a journal entry in QBO doesn't automatically know how to process a bill in Bill.com or run payroll through Gusto. The data structures are different. The API calls are different. The error handling is different.

Wet code

Harder to see but equally critical: the business rules, workflow logic, client-specific configurations, and contextual knowledge that determine how accounting actually gets done at your firm.

Which chart of accounts structure do you use for construction clients? What's the approval workflow for journal entries above $10K? How does your month-end close sequence work, and what are the dependencies between steps? When should an agent flag an exception in Slack versus email the partner?

This is the intelligence layer that lives in your team's heads. It's exactly what an agent needs to operate effectively.

For agentic automation to work in CAS, both layers need to be mapped, normalized, and made accessible to agents across the entire firm stack. Not just the general ledger. That's not a feature any single vendor is going to ship. It's a fundamentally different problem.

Omni: the nervous system for your entire CAS stack

This is why we built Omni.

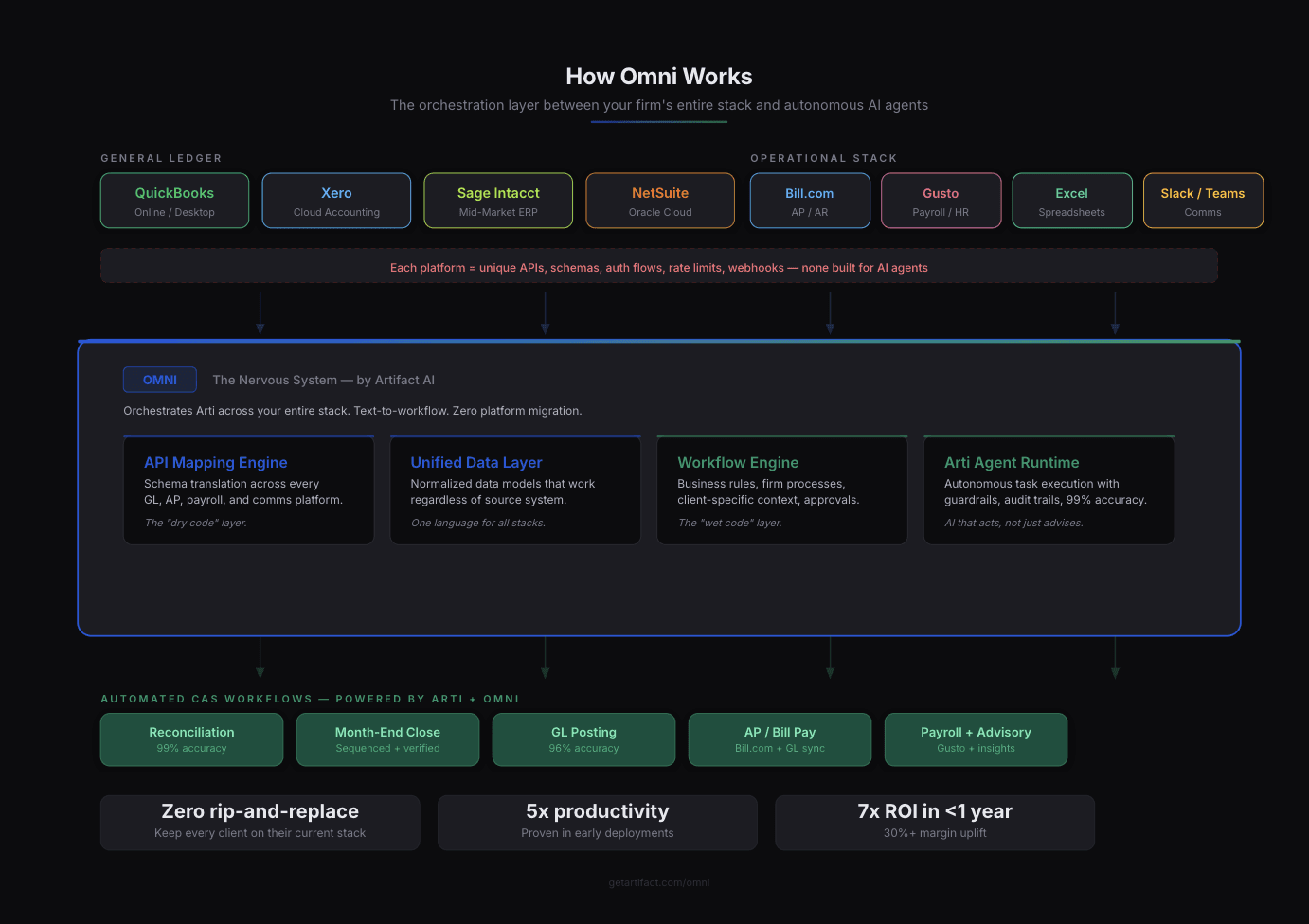

If Arti is the brain — the AI agent that reasons about accounting, reconciles transactions with 99% accuracy, and posts to the general ledger — then Omni is the nervous system. It's the orchestration layer that connects Arti to every platform in your firm's stack, so agents can execute end-to-end workflows across systems that were never designed to talk to each other.

We've spent day and night mapping every nuance of the major accounting platforms and the broader CAS ecosystem: every API schema, every rate limit, every authentication flow, every webhook pattern, every edge case in how data moves through QuickBooks, Xero, Sage, NetSuite, Bill.com, Gusto, Excel, Slack, Teams, and more.

We've built the data infrastructure that normalizes across stacks, so an agentic workflow that starts in your GL, routes through AP, triggers a payroll action, and notifies your team — all happens seamlessly, regardless of what platforms your clients use.

hink of Omni as the nervous system that connects Arti to every platform your clients use. Omni handles the dry code: every API, every schema, every authentication pattern across your GL, AP, payroll, spreadsheets, and communication tools. And it encodes the wet code: the business rules, approval workflows, and contextual intelligence that makes accounting work in the real world.

The result: your firm gets end-to-end agentic automation across whatever systems your clients already run. No migration. No retraining. No disruption.

Repeatability is the real unlock

Here's the thing most automation conversations miss: the hard part isn't automating one workflow for one client. It's making that workflow repeatable across fifty clients, each on different platforms, with their own configurations.

A CAS firm doing month-end close for a construction company on Sage needs a different sequence than a SaaS startup on QBO. Different chart of accounts. Different revenue recognition rules. Different AP approval chains. But the underlying structure of the work is the same.

The real power of an orchestration layer is the ability to build a workflow once, templatize it, and deploy it across your entire client base with client-specific configurations applied automatically. Your team builds a library of proven workflows that compound over time. Every new client engagement starts from a template, not a blank page.

This is how you break the linear relationship between headcount and client count. Not by working faster, but by making the work itself repeatable and portable across any stack.

Text-to-workflow: say it and it happens

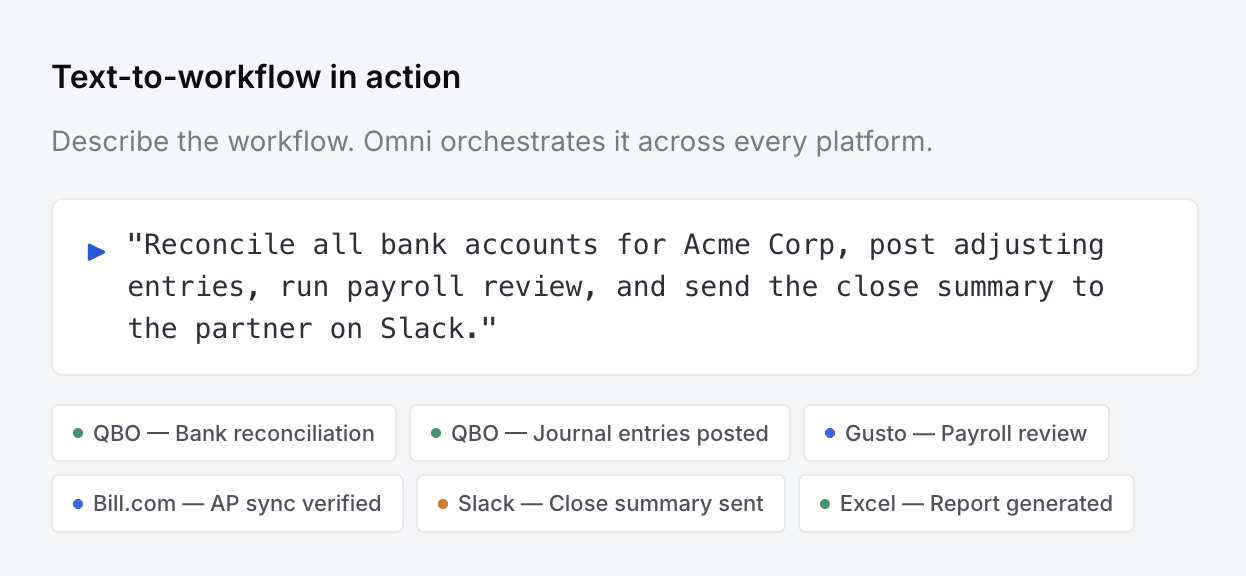

Here's what makes Omni fundamentally different from bolt-on integrations or point-to-point connectors: text-to-workflow.

Instead of building custom automations for every client on every platform, you describe what needs to happen in plain language. Omni translates that into an orchestrated workflow that spans your entire stack.

This isn't a chatbot bolted onto your accounting software. This is an orchestration engine that understands accounting, understands your firm's processes, and can execute multi-step workflows across systems that were never designed to work together.

The same prompt works whether the client is on QBO, Xero, or Sage — because Omni has already mapped the data infrastructure for each.

What this looks like in practice

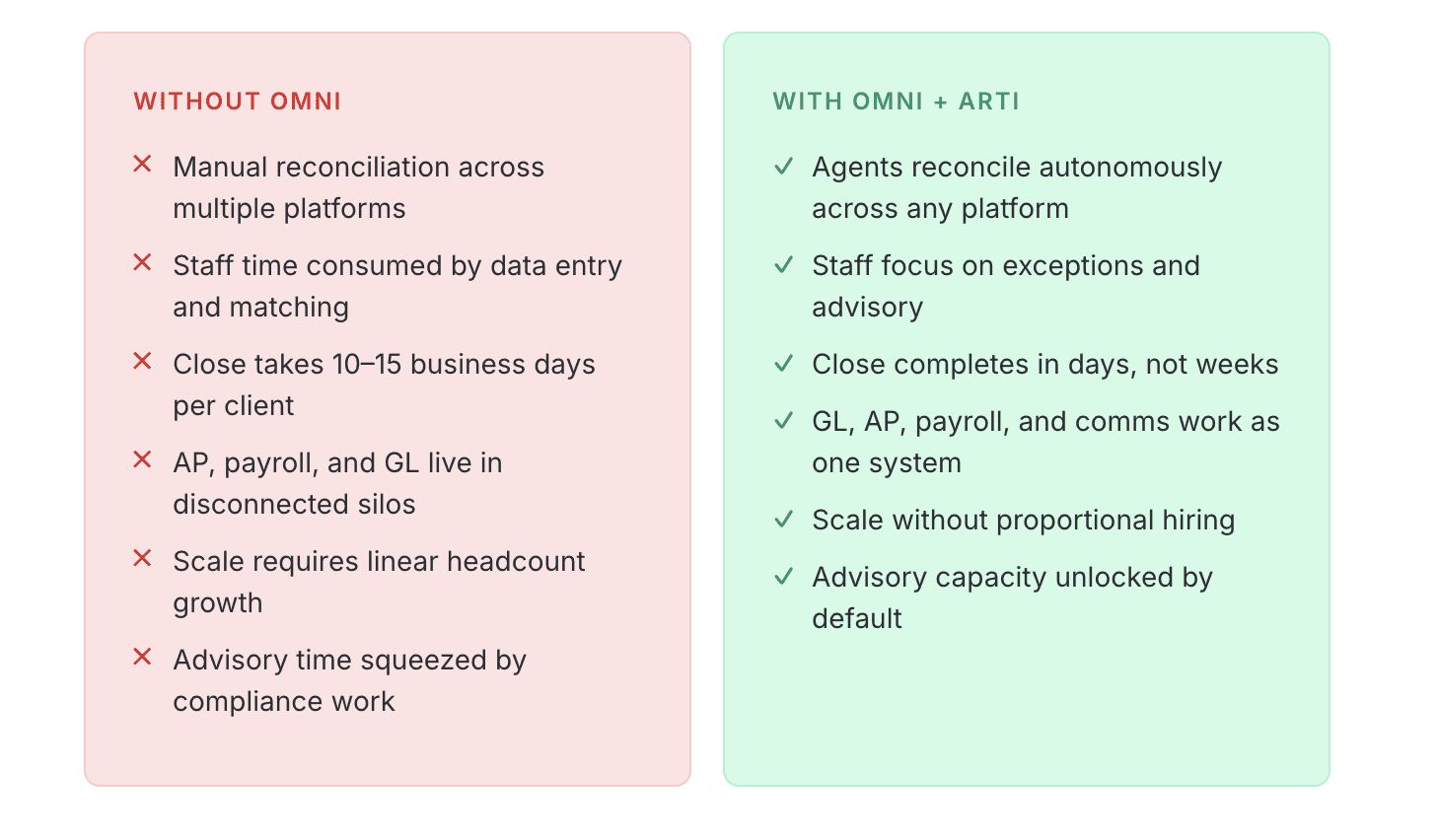

Consider month-end close, the workflow that consumes more CAS capacity than almost anything else.

Today, a staff accountant manually works through a checklist: pull bank statements, match transactions in the GL, check AP in Bill.com, verify payroll in Gusto, post adjusting entries, reconcile accounts, generate trial balance, compile financial statements in Excel, deliver the close package to the client, and notify the partner on Slack. Multiply that by 30, 50, or 100 clients.

It's brutal.

With Omni orchestrating Arti, the entire sequence executes autonomously across every system in the stack, regardless of which platforms the client uses. Arti reads the data, applies your firm's business rules, executes the workflow, flags exceptions for human review, and delivers the output.

Your team focuses on the exceptions and the advisory conversations, not the mechanical execution.

This isn't a future-state vision. In early deployments, Arti has already demonstrated 99% accuracy in reconciliation, 96% accuracy in GL posting, 5x productivity gains, and 7x ROI in under one year.

The firms that win will not be the ones that buy the best software

The next chapter of CAS belongs to firms that understand a simple truth: the competitive advantage isn't in the system of record. It's in the intelligence layer on top of it.

Every firm has access to QuickBooks. Every firm can buy Xero. The software is table stakes.

What separates the firms that scale from the ones that stall is whether they can make those systems work harder, whether they can deploy AI agents that operate across their entire client base, across every platform in the stack, autonomously, accurately, and without forcing a technology upheaval.

That's what we've built at Artifact. Arti is the brain. Omni is the nervous system. Together, they turn your existing stack into an autonomous accounting platform — with guardrails, audit trails, event-by-event traceability, and the kind of reliability that CAS demands.

Your system of record is fine. We're here to make it extraordinary.

See how Omni works with your stack

No migration required. No disruption. Just results.

Read more

Feb 12, 2026

We Ripped Out Material UI. Here's How It Went

Jan 5, 2026

We’re Not Automating Accounting. We’re Building Its Operating System.

Oct 28, 2025

From Data Overload to Decision Intelligence: How AI Is Changing Firm Performance

How explainable AI turns fragmented reports into trustworthy, next-best actions for firm leaders.